Healthcare Employment Continues to Grow for All of the Following Reasons Except

Eight reasons for rising healthcare costs

Published on July 8, 2022.

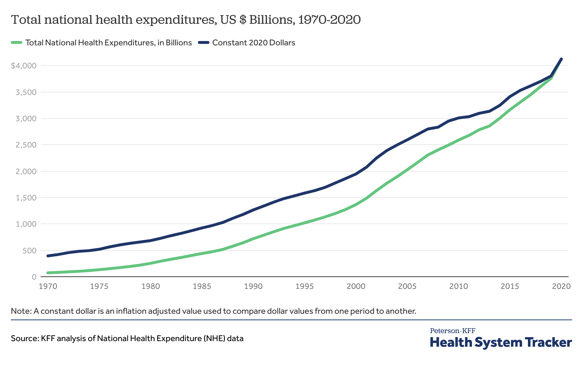

The average American spends a considerable amount of money on healthcare each year. Premium increases, higher deductibles and copays, and soaring prescription drug prices result in spikes in healthcare costs. According to the Centers for Medicare & Medicaid Services1, in 2021, healthcare costs skyrocketed to $4.3 trillion. Despite the decrease in health services accessed in 2020 due to the COVID-19 pandemic, national health expenditures are expected to reach $6.8 trillion by 20302. With no end in sight to rising health insurance costs, it's important to understand what exactly causes these spikes in the first place. Let's look at eight key factors for rising healthcare costs in the U.S and how you can offset your expenses with a health reimbursement arrangement (HRA). Find out how you can offset rising healthcare costs with an HRA from PeopleKeep Most insurers—including Medicare—pay doctors, hospitals, and other medical providers under a fee-for-service system that reimburses each test, procedure, or visit. That means the more services provided, the more fees paid. This can encourage a high volume of redundant testing and overtreatment, including for patients with a low potential for improved health outcomes. On top of this, the U.S. medical system isn't integrated. The World Health Organization 3 defines integrated health services as "the organization and management of health services so that people get the care they need, when they need it, in ways that are user friendly, achieve the desired results and provide value for money." So what does that have to do with cost? Integrated health means providers, management, and support teams communicate with one another on a patient's care. In an unintegrated system, the lack of coordination can result in patients receiving duplicate tests and paying for more procedures than they truly need. According to the Center for Disease Control and Prevention4 (CDC), more than half of the U.S. population has at least one chronic disease, such as asthma, heart disease, high blood pressure, or diabetes, which all drive up health insurance costs. A staggering 85% of healthcare costs5 in the U.S. are for the care of chronic health conditions. Moreover, recent data6 finds that nearly 40% of adults over 20 in the U.S. are either overweight or obese, which can lead to chronic diseases and inflated healthcare spending. As the U.S. population health issues increase, the risk of insuring the average American goes up. And in turn, the higher the risk, the higher the cost of annual health insurance premiums. Data from the Kaiser Family Foundation7 (KFF) shows that between 2011 and 2021, the average premiums for family coverage rose from $15,073 to $22,221—an increase of 47.4%. Medical advances can improve our health and extend our life, but they can also lead to an increase in spending and the overutilization of expensive technology. According to a study by the Journal of the American Medical Association 8 (JAMA), Americans tend to associate more advanced technology and newer procedures with better care, even if there's little to no evidence to prove that they're more effective. This assumption leads both patients and doctors to demand the newest, and often most expensive, treatments and technology available. Data from the KFF9 finds that roughly 49% of the U.S. population gets their insurance through their employer. That means nearly half of Americans don't make any actual consumer decisions about the cost of their insurance because their employer already determined it. Organizations are incentivized to purchase more expensive health insurance plans because the amount employers pay toward coverage is tax-deductible for the organization and tax-exempt to the employee. In addition, low deductibles or small office co-payments can encourage overuse of care, driving demand and cost. Despite a wealth of information at our fingertips online, there's no uniform or quick way to understand treatment options and the cost of care. We would never buy a car without comparing models, features, gas mileage, out-of-pocket cost, and payment options—but yet, this is how we buy healthcare. Kaiser Health News10 (KHN) reports that even when evidence shows a treatment isn't effective or is potentially harmful, it takes too long for that information to become readily known, accepted, and change how doctors practice or what patients demand. And in too many cases, even when hospitals make their service prices available, they are challenging to navigate and understand. To mitigate this lack of transparency, Congress passed the No Surprises Act in January 2022. The Act aims to reduce surprise medical bills under private health insurance plans and create better pricing transparency to improve the patient experience and control costs of expensive health conditions. According to the Center for Studying Health System Change11, mergers and partnerships between medical providers and insurers are one of the more prominent trends in America's healthcare system. Increased provider consolidation has decreased individual market competition, in which lower prices, improved productivity, and innovation can occur. Without this competition, these near-monopolies have providers and insurers in a position where they can drive up their prices unopposed. For example, a study done by the American Journal of Managed Care 12 found that hospitals in concentrated markets could charge considerably higher prices for the same procedures offered by hospitals in competitive markets. Price increases often exceed 20%13 when mergers occur in concentrated markets. However, reviews found these cost increases didn't improve healthcare quality. Frequently called "defensive medicine," some doctors will prescribe unnecessary tests or treatment out of fear of facing a lawsuit. The cost for these treatments increases over time—a study has shown14 that the average price of defensive medicine is around $100 to $180 billion yearly. This is no surprise given that our current regulatory system is structured to support the fee-for-service healthcare delivery and payment model. The Commonwealth Fund15 reports that the fear that healthcare providers will withhold important clinical services to stay under budget is a more significant concern to Americans than the overutilization of services. Healthcare inflation is slowly increasing as patients are returning to doctor's offices after avoiding them throughout the pandemic, causing many people to cancel physician services. Inflation affects the costs of operations, supplies, administration, and facilities. Additionally, healthcare facilities have taken a hit due to continued staff shortages and lower annual incomes for healthcare workers. According to KFF16, in April 2022, overall inflation prices grew by 8.3% since last year, while healthcare prices increased by only 3.2%. But even though healthcare inflation hasn't outpaced general inflation yet,, some medical services and items saw an increase in costs. Annual costs for hospital services—including inpatient (3.7%), outpatient (3.3%), and nursing care facilities (3.6%)—rose faster than overall medical care prices (3.2%). However, prescription drugs and physician services had lower price increases (1.7% and 1.2%, respectively). Many individuals are worried that healthcare inflation will eventually overtake any increase in their annual income, so they're debating whether to cancel or postpone their care—much like they did during the pandemic—until they can get their financial situation under control. But due to the delayed effect of inflation in healthcare, patients should get their healthcare needs fulfilled sooner rather than later, especially if they have chronic conditions. As healthcare spending continues to climb, there's never been a better time to ask your employer about offering an HRA—an easy way to lower your annual premium and out-of-pocket health costs by getting qualified expenses reimbursed through your employer. HRAs help employers better control their health benefits budget, avoid unexpected rate increases, create customized plan designs, and give their employees more control over health spending, no matter their current health status. Not all employers want to let go of their group health plan. Luckily, there is an HRA that supplements employer-sponsored health insurance—the integrated HRA. Integrated HRAs are for employers of any size looking to boost their group health insurance policy by offering a reimbursable, unlimited allowance amount to employees for medical expenses that aren't fully covered by their plan. Integrated HRAs work with any employer-sponsored health plan. But by incorporating a high-deductible health plan (HDHP) with an integrated HRA, employers can offset annual rate hikes and health plan premiums. Employers and employees can save more money on their monthly premiums with an HDHP, and the HRA will cover out-of-pocket costs and health condition services that the lower-tier health plan may not cover. The integrated HRA that PeopleKeep offers on their HRA administration platform is called a group coverage HRA (GCHRA). With PeopleKeep, employers can quickly and easily sign up for a GCHRA and start offering their new benefit immediately. Even better, PeopleKeep's team of experts will handle HRA compliance, review and store documents, and provide top customer support so employers can focus on running their business and taking care of their employees. While there's no single reason to blame for rising health costs or a premium hike, understanding a few critical factors can help keep you informed and aware of your options so you can make educated and private insurance decisions. If you're an employer with a group health insurance plan, an integrated HRA is an excellent way to keep your health benefit and administrative costs low while offering your employees an affordable health benefit with greater coverage. Get an integrated HRA through PeopleKeep by scheduling a call with a personalized benefits advisor today. This article was originally published on May 9, 2014. It was last updated on July 8, 2022. 1https://www.cms.gov/files/document/nhe-projections-forecast-summary.pdf 2https://www.cms.gov/newsroom/press-releases/cms-office-actuary-releases-2021-2030-projections-national-health-expenditures 3https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7880002/ 4https://www.cdc.gov/pcd/issues/2020/20_0130.htm#:~:text=More%20than%20half%20(51.8%25),adults%20had%20multiple%20chronic%20conditions. 5https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7077778/#:~:text=Today%2C%20chronic%20disease%20affects%2050,It%20has%20become%20an%20epidemic.&text=Comparison%20of%20the%20national%20health,the%20annual%20cost%20of%20living. 6https://www.singlecare.com/blog/news/obesity-statistics/#:~:text=What%20percentage%20of%20Americans%20are,of%20Public%20Health%2C%202020). 7https://www.kff.org/report-section/ehbs-2021-summary-of-findings/ 8https://www.medschool.lsuhsc.edu/emergency_medicine/docs/overutilization.pdf 9https://www.ehealthinsurance.com/resources/small-business/how-many-americans-get-health-insurance-from-their-employer 10https://khn.org/news/health-care-costs/ 11http://www.hschange.org/CONTENT/1230/ 12https://pubmed.ncbi.nlm.nih.gov/21756018/ 13https://www.healthaffairs.org/doi/10.1377/hlthaff.2017.0556 14https://medcraveonline.com/NCOAJ/NCOAJ-06-00181.pdf 15https://www.commonwealthfund.org/publications/fund-reports/2010/feb/potential-global-payment-insights-field 16https://www.healthsystemtracker.org/brief/overall-inflation-has-not-yet-flowed-through-to-the-health-sector/?utm_campaign=KFF-2022-The-Latest&utm_medium=email&_hsmi=215347031&_hsenc=p2ANqtz-8k1ZbD4QxyRcuNmz397etKGYhZ5Ub0AhjVO0bGiswhALKIjXpnhLboCpoq3BOVsDaI3LXmJLxV7Rhh9x-n3LtyF5lDmK4HyNhTQhuTrwTefjdvtRI&utm_content=215347031&utm_source=hs_email#Change%20in%20total%20Consumer%20Price%20Index%20for%20All%20Urban%20Consumers%20(CPI-U)%C2%A0for%20medical%20care,%20by%20category,%20April%202021%20-%20April%202022%C2%A0%20%C2%A0

1. Medical providers are paid for quantity, not quality

2. The U.S. population is growing more unhealthy

3. The newer the tech, the more expensive

4. Many Americans don't choose their own healthcare plan

5. There's a lack of information about medical care and its costs

6. Hospitals and providers are well-positioned to demand higher prices

7. Fear of malpractice lawsuits

8. Inflation's impact on the economy

How an integrated HRA can alleviate rising premium costs

Conclusion

Originally published on July 8, 2022. Last updated July 8, 2022.

Share: ![]()

![]()

![]()

Source: https://www.peoplekeep.com/blog/eight-reasons-for-rising-health-care-costs

0 Response to "Healthcare Employment Continues to Grow for All of the Following Reasons Except"

Post a Comment